Miami is one of the most vibrant cities in America, filled with sun, sand, Latin rhythms and some of the best restaurants and clubs in the world. Miami is also the hub for watch distribution into the Latin American market. Though Latin America isn't a major market yet, the potential is there because of the number of developing countries and the huge population. These same benefits are also challenges, as each country has its own culture, economics, politics and problems.

What is Latin America?

Latin America is an immense area, encompassing some 20 countries with a population of 560 million people. "Latin America is sometimes defined as the area of the Americas where romance languages (those based on Latin) are spoken.

Within this block are 20 independent countries. Other times, especially in the United States, the term refers to all of the Americas south of the U.S. It is a region which includes most of Central and South America and parts of the Caribbean,“says James S. Wylde, a Latin America human resources specialist.

”Latin America includes a full spectrum of cultures and economies - from that of Chile, the economic wonder child of the hemisphere, to countries like Venezuela and Bolivia, where a recent swing to the political left is producing dramatic transformations in both the public and private sectors,“Wylde continues.”For more than a century, the Americas have served as a theatre for upheaval, often due to national struggles for sovereignty which are intertwined with dramatic social inequities and export-led development."

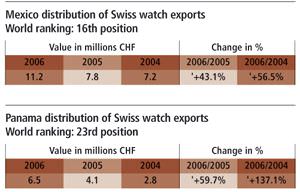

Figures provided by the Federation of the Swiss Watch Industry FH – www.fsh.ch

Why Miami?

Miami is the base for going into the Latin American market for a number of reasons. Firstly, it's secure and high-tech, being in the stable United States. An office in Latin America would be subject to the instability of the region. Secondly, it's close to the Latin American market. Distributors can reach all the important cities within a nine hour flight from Miami, with many cities much, much closer. Lastly, Miami is a major hub for retailers who are travelling anywhere, so often they can visit the agents and distributors in Miami on their way out of or back to their country.

“It makes sense to run the operation from Miami, because it's easy to fly and reach these regions,” says Julio Sato, Brand Manager, Panerai for Latin America and the Caribbean. “The structure we have in Miami is very good for the Richemont Group.”

Bell & Ross has its US office in Miami, so it made sense to handle Latin American distribution through there as well. “Most of Latin America and the Caribbean are here at one point,” says Matt Newton, Sales Director, Bell & Ross the Americas. “You don’t really have to go to them as often, because they often transfer through Miami on the way home. They vacation here, they do business here. So far, handling the distribution from Miami is working well. We have a hot product right now and the dealers are coming to us.”

Selling watches in Latin America means travel...and lots of it. “You can commute from here to Latin America very easily,” says Rick De La Croix, President, DLC Trading (distributor for Corum, Hublot, Maurice Lacroix and Escada for Mexico and Latin America). “You can get everywhere within three to nine hours. In Latin America, luxury goods are high risk for robberies, kidnappings. A lot of distributors have security problems. We do have goods in Miami, which the smaller accounts collect when they come to Miami. Other larger accounts are shipped directly from the factory in Switzerland.”

Size of the Market

With so many people, Latin America is certainly a market worth targeting. However, in most of Latin America, not everyone is a buyer for watches. The split between the haves and have-nots is very wide, depending on the country.

“Latin America is a strong market for luxury goods, but there is a very large gap between the rich and the poor,” says Cecile Melanie, Brand Manager for Latin America and the Caribbean, Jaeger-LeCoultre. “Business varies from country to country. There are countries where we are not yet represented, because some markets don't have the maturity yet, like Peru, Honduras, Nicaragua and Bolivia.”

Some countries in Latin America are strong while others are just getting started. “I don't know how big the market will be for watches in general,” Bell & Ross' Newton says. “It is so polarized between the haves and the have-nots. The haves are always coming to the US and they can buy their product here. Mexicans go to Vail for vacation, South Americans come to Miami to shop, and so they can always buy their watches here. There's a substantial market for the very low-end, there is a solid market for the high-end, and the middle priced brands like Bell & Ross will find it tough to have it be a big market for us. In our price category, the person who can afford our watch can afford the Audemars Piguet and whatever else they want.”

The potential is certainly there, but Latin America definitely represents a long-term commitment with no guarantee of a quick return on investment. “Latin America is a very young market,” concedes DLC Trading's De La Croix. “The population is young; the Latin American consumer is 20 - 35. There is a very rich class and an emerging class, from poor on upwards. It's easier to sell high-end pieces in Latin America than it is to sell low-end pieces. What I sell at retail, and we sold close to 3,000 watches at retail, averages US$6,000 a piece.

”Latin America is like the wild, wild west,“De La Croix continues.”They are emerging markets. We'd like to think that Latin America is like China with emerging potential, but then you have politicians in each country and the USA, which can really shake things up. Depending on how you group and classify Latin America, there are as many as 800 million Latins in this market."

Distribution

Some watch brands use agents to handle their distribution in Latin America, Mexico and the Caribbean, while other brands prefer to do it themselves. The argument for an agent is that it takes special expertise to handle Latin America distribution and it's difficult to create that expertise.

“You have to be a specialist,” says DLC Trading's De La Croix. “A lot of the major brands have tried; they have opened offices and fallen on their faces. My wife is Columbian and I lived in Latin America for a long time. I have learned the idiosyncrasies, how they think, what makes the country work. You have to be very close to the market. I spend around 200 days a year travelling. We are constantly in the customers' faces, making sure our products are pushed.

”It's a huge geographic market — if you go from Tijuana to Tierra Del Fuego, it's the same distance from Los Angeles to Tokyo,“he continues.”Going from Miami to Buenos Aires is a nine and a half hour flight. The return on investment is not there for the large groups. With Corum, I have 55 doors. It's a small market and you have to really work it."

Some brands decide to take on the challenge of doing the distribution directly, which means a serious commitment of resources, time and money, as well as a cultural commitment to working with these countries, and their retailers, directly.

“Every country imports directly from Switzerland,” explains Panerai's Sato. “We don't work with agents, which is what helps us a lot to pass the message to the clients. We have the direct contacts through me. I meet with the retailers in person, so I can identify the needs more directly, and we don't mix up our message. We are still developing our network, especially in the Caribbean and Mexico. Due to the fact we have limited production, we can't open every country we want to.”

The pictures are from the ‘La Hora’ chain, the leading luxury watch retailer from Panama and Colombia. They retail exclusively Hublot - Corum - Blancpain- Glashütte and Chanel.

They also represent Breitling, TAG, and other Swatch Group brands.

Challenges

Latin America is so big and encompasses so many countries; it can be a mistake to consider it one cohesive region. “Although U.S. media conglomerates often approach Latin America as a single demographic entity, the cultures of the countries in the hemisphere are dramatically different, both from the perspective of history and development as well as in their use of language,” says Latin America human resources specialist Wylde. “Spanish vocabulary, for example, can vary significantly from country to country. Marketers are best advised to attune their messages to suit the needs of the particular country and market of choice.”

The language might be the same, but little else connects Latin American countries. “All the Latin American countries speak Spanish, apart from Brazil where they speak Portuguese, but they are not interconnected,” adds DLC Trading's De La Croix. “Each market requires you to know how to create the demand because there is no publication that serves all the different markets. Selling in Honduras is different from selling in Uruguay. What becomes difficult is when you take a country like Mexico, where you have big newspapers and magazines, but the people from the north read different things than the south. Everything is divided and that means time, effort and investment.”

“It's very difficult and frustrating because you can't have a long term vision, which is what most brands need,” he continues. “This year, we have the elections in Mexico, Venezuela, Columbia and Brazil, which we are very concerned about. If they anger the U.S., trade might be restricted. I can't tell you where watches are going. Life can change so quickly without any indications. In the US, you can see the trends. When it goes down in Latin America, you won't know what hit you. Not that the retailers in this region won't pay, they will, but it might take six months instead of two months. The Swiss want vision and strategy, which we really can't give them.”

Coping with the different politics, social mores and customs can be quite difficult. “The biggest challenges are to understand and try to cooperate with the different social, economic and political issues,” says Panerai's Sato. “In countries like Venezuela, Argentina and Brazil, important markets, the policies of import and taxes can be quite challenging. The most interesting part is that these countries don't produce their own watches, so I don't understand why they are protecting the markets with taxes that are so high.

”The Caribbean alone is 16 countries, with different cultures, different issues, currencies and rate variations and local taxes,“Sato continues.”For the countries not affiliated with NAFTA (The North American Free Trade Agreement), taxes can be a big problem. Import taxes, local taxes and duties can really influence the price (some countries can go up to 75%). When you are talking about the Caribbean, 95% of the market is the tourist business, and in Latin America, it's the local market."

Though Latin America is a developing region, the elite are very cosmopolitan and sophisticated. “If we were dealing with the consumers down there, customs would be a concern, but the jewellery store owners are the elite of the country, so they are very familiar with American customs,” Bell & Ross' Newton explains. “Most of them speak English to some degree. They are not taken aback by the American way of doing business. I've been in Miami for 11 years now, and my wife is Columbian, so I know a little more about the culture than the average person. There is a certain degree of familiarity they like before they do business. They like to talk about non-business issues before they go into the business.”

The retailers in Latin America are quite a bit different from Europe and America. There are very few chain stores, most of the retailers being stores owned by the same family for generations. “A lot of the retailers are family businesses, so they have to be treated a little bit differently,” says Jaeger-LeCoultre's Melanie. “Sometimes they don't have the same aggressive approach as the new jewellers. They know how to ride out a crisis, however. Even though a crisis will impact the market, at this level of luxury goods; it doesn't affect them that much. Between natural disasters and economic disasters, we are used to it.”

The Latin American market is huge, volatile and still developing. Like China, it makes sense for brands to get into the market early, so when the investment starts to pay off, it can pay off handsomely.

Source: Europa Star June-July 2006 Magazine Issue