I showed up at the Hong Kong Watch & Clock Fair not really knowing what to expect. I know who goes to BaselWorld and SIHH, and I know the purpose of JCK in Las Vegas, but I wasn’t sure who went to the Hong Kong Watch & Clock Fair, nor did I know why.

So, jet-lagged and suffering from the heat and humidity of late summer in Hong Kong, I walked into the show...and my questions were answered.

The purpose

There are a number of purposes to the Hong Kong Watch & Clock Fair. First and foremost, distributors and importers from countries around the world come to Hong Kong to see the newest lines of product. These com-panies buy watches outright to distribute in their countries, under the brand name of the manufacturer.

Secondly, the show serves as a clearinghouse of companies in Hong Kong and China who can work as OEM (original equipment manufacturer) and ODM (original design manufacturer) companies, essentially outsourcing. OEM is when a company goes to a manufacturer and has them make watches according to their design and specifications and then sells them under their own brand name, while ODM is when a company purchases existing or made-to-order designs from the manufacturer and put its own brand name on these products.

There were many buyers who were looking to find the latest designs and incorporate them into their lines, while at the same time companies were looking for manufactures to work with on the design side to make new watches. Many exhibitors at the Hong Kong show have decades of experience working on all three sides – branding, ODM and OEM. Whatever buyers were looking for they could find in Hong Kong.

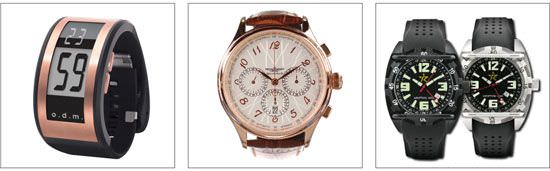

odm, Bretenbach, Rogue

Buyers also come to Hong Kong to find pieces and parts for their lines. Some established international brands were in Hong Kong to find the best and newest straps, dials, cases, boxes, packaging materials and more. In today’s competitive watch world, buyers are always looking for the latest and greatest. If you aren’t moving forward, after all, you’re falling behind.

There was also an entire section of the show dedicated to equipment manufacturers, so watch brands and manufacturers could search for the latest technology. It really was a one stop shop – if you wanted to show up in Hong Kong and set up your own company to make a watch with your name on it, after three days in Hong Kong, you could accomplish your goal.

One example of the new technologies on display was IZ gold from Coming Technologies – an innovative way to suspend real 24 carat gold leaf in plastic. “This technology was developed after Basel,” says Paul Tsang, Marketing Manager, Coming Technology. “We are very strong in plastic bangle watches. We did lots of research, lots of trial and error, before we figured out how to suspend the gold flakes in the plastic. It doesn’t add much cost, about 20 per cent more, because the gold flake is very thin. We can put as much gold into the plastic as the customer wants. The majority of our business is OEM. The reaction to the new gold product has been very good, better than we expected.”

Another new product, a watch with a mirror finish that displayed the time when the watch was moved, was from Best Power, shown under the Romaro Brand. “We wanted to develop a watch that women can use and don’t have to take a mirror out of their purses,” says Monne Yeung, General Manager, Best Power. “The watch has a mirror dial, but when you move your wrist, it shows the time via a light under the dial.

Coming Technologies, Sea-Gull, Geya

We are looking for agents for the Romaro brand. If one of the top fashion brands likes our concept, we can do it for them as well. Our plan is to show the watch at trade shows, using the mirror watch to build the Romaro brand.”

The largest movement manufacturers were displaying at the show, Sea-Gull and Shanghai, as were a number of lesser known movement manufacturers. In addition, there were a number of companies using Chinese movements in interestingly designed watches. Ingersoll brand, by Zeon Limited out of Hong Kong, is a line of mechanical watches made in China, using automatic movements from Shanghai and Sea-Gull, ranging in price from $290 - $500. “In our markets, the price is the main thing, and these watches are a very good value,” says Robert Dorfman, Vice Chairman, Zeon Limited. “The finish is fantastic, and the watches are largely designed in Germany, and they have a good feel for the right designs. Gandhi wore an Ingersoll watch and so did Mark Twain.”

One particularly attractive watch was from Topsford, featuring a hand made cloisonnÉ dial with a traditional dragon design. “We are selling these models in the Hang Seng Bank here in Hong Kong,” says Paul Wai, Manager, Topsford. “The cloisonnÉ is hand-done by artisans in Shanghai. It takes 45 days to do the dial, from the raw brass to the finishing. One group of artists do the dial, switching from colour to colour.”

Eyki, Triumph, Evisu

The brands?

Companies from Hong Kong and China have been doing OEM and ODM business for so long, the leading companies are ready for the next step – and that means developing their own brands.

To this end, the HKTDC had a brand name gallery on exhibition throughout the show, even open to the public on the last day. To be fair, these are not brands anyone outside of Hong Kong would recognize. Here are just a few of the weird and wonderful names:

![]() Android

Android

![]() Angel Clover

Angel Clover

![]() Elmer Ingo

Elmer Ingo

![]() Lulucastagnette

Lulucastagnette

And my personal favourite, Pryngeps Milano, which I had to ask how to pronounce, and even though the woman told me, I still don’t know how to pronounce it. I asked her if this was a family name and she said, no, it was chosen specifically to be a brand name (!).

“Brands are able to weather financial storms much better than unbranded items,” says Raymond Yip, Assistant Executive Director, HKTDC, explaining his push for more brands at the show. “People in Asia are getting richer and richer and they are looking for more branded products. They are willing to pay more for branded items, so we need to develop more brands of our own. About 40 per cent of our industries are doing brands, 80 per cent are OEM and 60 per cent are ODM. Many companies do all three (that’s why the numbers don’t add up to 100 per cent). In addition, China is opening up. There is a big middle class, 300 million people, and a big appetite for brands.“

It might make sense for the second and third tier Swiss brands to exhibit at this show, in the brand name gallery, to try to gain entry to the world’s biggest market – Hong Kong and China.

One of the few recognizable Hong Kong brands, o.d.m., was well represented at the show, launching a new watch using E-Paper dials. ”We are going to launch in North America and we are currently restructuring Europe,” says Jack Kwong, Brand Manager, o.d.m.. “We have new distributors in France, Italy and the Netherlands. Our price range is $60 - $200, and our core target is $100. We are fun accessories. Our watches are made in China and the movement for E-Paper is just for us. We use some Japanese movements and some of our own movements. We are fun accessories and we like to offer some tricks, surprises, new technology. Our target customer is from 18 – 25 and our watches are designed as impulse purchases. They are easy to understand, with interesting features, great packaging. We are doing some collaborations with designers, like Michael Young from the UK and JCDC from France. The designers give us the designs, we make them work.”

Amundsen, Daniel Hechter, Zerone

The design competition

One of the highlights of the Hong Kong Watch & Clock Fair is the design competition, where students and designers can ‘think out of the box’ and come up with whatever designs they want to. Though not necessarily commercial, it’s a pleasure to see what people come up with every year.

This year was no disappointment, as there were several designs that were worth a look.

The show as a whole

Though the exhibitors were upbeat and optimistic, the lack of foot traffic at this year’s show was a real disappointment. Due to the crisis, some downturn was expected, but I don’t think anyone was prepared for the dearth of buyers. Luckily for many companies, one of their largest markets is China, so business is better than horrible, though a strong show would have helped a great deal.

“Business is slow, and I had really hoped the show would be successful,” says Fredi Chan, owner, Perriland. “In Basel, people didn’t buy. Our main customers are importers and I had hoped they would buy this year, but orders are still very slow. We do it all, except for branding and now we will all consider branding in the future. Only the Chinese market is up, so Hong Kong brands have to work to set up their brands. I prefer OEM business, because there is no risk. But now, there are no orders, so we are reconsidering our own brand.”

Nice Bride, Cyril Ratel, Cosmopolitan

Solar Time Ltd. has licensed products, like Giordano, Evisu and Triumph Motorcycles, and the Black Dice brand as a partnership. “Most of our business is OEM, 70 per cent, but we are also developing our own brand,” says Vishal Tolani, Director, Solar Time Ltd. “We do the design, concept, and offer customers a turn key operation. We profile the people we want to work with and we do proprietary products for our clients. This show is how and where it all starts, someone who wants to start a new watch brand in a couple of days’ time. This is the best show for that, it’s about what makes the watch industry tick.”

Though foot traffic was down in the overall show, it was particularly evident in the Brand Name Gallery, which was in a sep-arate location.

“This was the worst show in the eight years I have been coming to Hong Kong, in terms of traffic,” says Adnan Arif, Brand Manager, Western. “There is no one here. Western is a 20 year old brand, based in Hong Kong, but we also do OEM and ODM, where we develop watches for other brands. Western is starting to get a name for itself in North Africa, Europe, the Middle East. We would like to go into China, but it’s hard to find reliable distributors.”

Jimmy Olmes, President of Reactor Watch Company, was at the fair to look for component suppliers. “The show was not all that well attended and many of the vendors were complaining about traffic and sales,” he observed. “This was to be expected as the watch and jewellery markets are still very depressed with too much inventory still in the pipe line. I talked to one of the major movement suppliers and his comments were he had never seen business this bad in 40+ years. He claims that most of the major Swiss brands have 18 to 24 months of watches sitting on their shelves. Movement manufactures are virtually shut down until this demand opens back up.”

Not every exhibitor was slow. One movement maker, who introduced two new mechanical calibres at the Hong Kong show, Time Module (HK) Ltd. saw good traffic. “The show was fine for us,” says Jane Chu, Assistant Manager. “The traffic to our booth was satisfactory, with many new and existing customers interested in our new products including the mechanical movements we displayed. Generally speaking we feel positive about the result.

Mike Gee is the owner of Rogue Warrior Watches and he was satisfied with the traffic and with the show in general. “I found the traffic a little less than last year but still OK,” he says. “Anyone who is a serious player goes to the show and those that do not go are probably suffering from the economic downturn, Because we do not sell to stores only 1 per cent of the attendees are our customer. If we get one new exclusive distributor for a new territory, that's good for us and at this show three new distributors came on board.

“We mainly go to this show to back up our factory which looks to promote the fact that they manufacture the Rogue Warrior watches,” he continues. “For them, it's a prestige statement, and because they were allowed to show our watches in the booth window, they nearly doubled their sales over last year. Most watch brand companies do not want their manufacturers displaying the fact who they manufacture for, but we take the opposite view in that by helping our supplier, the factory gets stronger and does appreciate what we do to help them and in turn they support us when needed.”

Though the China market remains strong, most of the exhibitors were looking for access to other markets – Middle East, South East Asia, Europe – and these buyers seemed to stay away.

Estimates are that show attendance was down by at least 50 per cent, which is a result of the crisis, not the quality of the show or the exhibitors.

My impressions?

I was pleasantly surprised at the amount of quality timepieces on display. You have to remember that the ‘quality’ I speak of is relative to the price points on offer here – for the price (the core being between $10 and $300), there was a lot of interesting product on offer.

The heat and humidity never let up while I was in Hong Kong, but my scepticism certainly did. The Hong Kong Watch & Clock Fair is an important show, especially for the Asian region, and I can’t wait to go back.

Source: Europa Star October-November 2009 Magazine Issue