- Sales in the prestige watch sector (top luxury brands without Omega) were up 28% year-on-year in constant exchange rates in 2004 and at 2004 exchange rates by over 25%

![]() Sales in the luxury segment including Omega were some 16% up on 2003 in constant exchange rates and over 13% higher at 2004 exchange rates

Sales in the luxury segment including Omega were some 16% up on 2003 in constant exchange rates and over 13% higher at 2004 exchange rates

![]() Currency movements had negative impact on the Group of CHF 60 million, or 1.5%, with CHF 56 million of this sustained in the second half-year alone

Currency movements had negative impact on the Group of CHF 60 million, or 1.5%, with CHF 56 million of this sustained in the second half-year alone

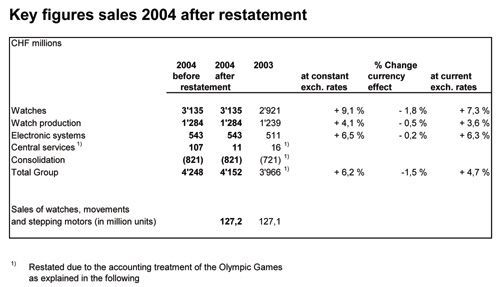

![]() Group sales in 2004 were up 6.2% year-on-year in constant exchange rates and 4.7% at current exchange rates

Group sales in 2004 were up 6.2% year-on-year in constant exchange rates and 4.7% at current exchange rates

![]() Market shares increased in all important markets and segments

Market shares increased in all important markets and segments

![]() Positive rebound in production of watches, movements and components

Positive rebound in production of watches, movements and components

![]() Dynamic outlook for sales in 2005

Dynamic outlook for sales in 2005

Overview Group

All Group divisions reported higher sales last year. Growth was strongest in the watches segment with an increase of 9.1% in currency adjusted terms. The adverse effects of currency developments on growth were particularly noticeable in the second half of 2004. Whereas the first half of the year looked good in comparison with a weak first-half 2003, the comparison base for the second half of the year was significantly higher.

Despite these demanding targets, the Group continued to post strong growth in all segments in the second half as well.

After in-depth discussion of the budget projections and action plans for all group units in 2005, the Board of Directors and Executive Group Management Board expects to achieve further solid growth in Swiss franc terms this year. Implementing these plans and objectives will require full commitment from all the Group's employees and management staff, but is also dependent on positive support from other factors such as currencies and the economy, which are beyond our control.

The first month of the current year is already showing signs of this strong growth.

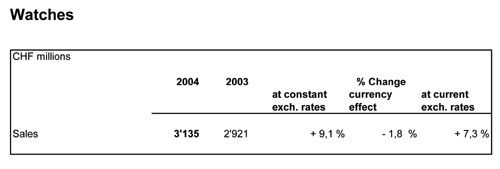

This important group division, the Swatch Group's core business, again posted above-average growth in 2004. Double-digit growth rates were achieved in the prestige, luxury and top market ranges, while the other sectors reported single-digit growth. Currency effects reduced the increase in sales for the entire watch segment by CHF 52 million or 1.8%, almost all of which occurred in the second half of the year.

Thanks to targeted efforts on the product and marketing side the Breguet brand saw an outstanding performance with strong gains in market share; but also Blancpain, Glashütte, Jaquet Droz, Léon Hatot and Omega confirmed the market potential in the top range and followed this trend. Omega, which made the most significant contribution to growth in absolute terms raised its average prices in many markets and extended its absolute leadership position. Longines and Rado also reported pleasing developments with a strengthening of their respective positions.

In the medium range the Tissot and cK brands posted growth rates in high single digits. In the basic range, growth in the Swatch and Flik Flak brands was more subdued. This sector is most affected by the strong Swiss franc or weak dollar-linked currencies and price adjustments can only be made on a very selective basis. In addition, these brands have the strongest exposure to competition from firms producing in China.

While Europe proved an extremely challenging environment for many brands, the markets in Asia and the Middle East generally performed very well.

The strategy of extreme caution with regard to price adjustments was continued in 2004 and was an important factor – alongside our attractive product offering in all price categories and our global distribution capabilities – in gaining further market share.

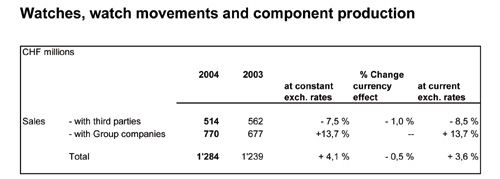

As already announced in our interim report, the production division saw a sharp rebound in the second half of 2004. Although orders from third parties were still below the year-earlier figure in the second half, the shortfall was more than offset by the ongoing growth in demand from the Group brands. Particular highlights in 2004 were advances in the design and production of jewelry for the Breguet, Léon Hatot, Omega, cK and Swatch brands as well as the centralized purchasing of diamonds for all the Group's brands. As a result of the marked growth in the high-end collections of the luxury and prestige brands these activities developed especially strongly.

Further expansion, but also rationalization measures, are planned to further strengthen this segment in the near future.

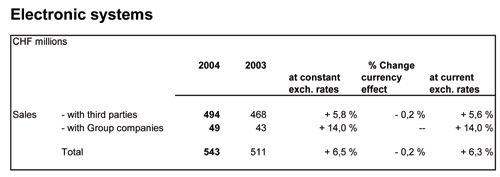

Overall the units in this division developed very positively in 2004. Momentum slackened somewhat in the second half of the year, however. This is principally attributable to the cyclical slowdown in the electronics and mobile telephone sector. The Group's subsidiaries Renata and Micro Crystal were most sharply affected by this. On top of this they were exposed to ongoing pressure on prices which is even more pronounced when the industry is in a downturn phase. The strong Swiss franc mainly impacted sales in the dollar area and in dollar-linked currencies, especially during the second half of the year.

The development in this area is expected to be cautious initially during the first few months of the current year. Experience shows, however, that these economic cycles tend to be of short duration.

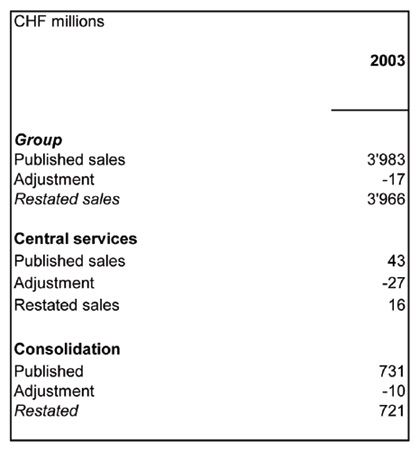

1) Change in accounting treatment of the Olympic Games

The Swatch Group has given a provisional commitment to provide the timekeeping and sports results for the Olympic Games up to the year 2010 in return for advertising possibilities and identification rights. This results in a net expense for the Group. In view of this fact these items will in future be reported gross in the consolidated accounts under “Other operating income and expense” and will therefore no longer appear in sales.

This results in the following adjustments to the sales figures for the previous year:

Expected earnings for 2004 and initial outlook for 2005

A further increase in the already high level of operating profit is expected for 2004. Negative currency movements have not only affected sales but will also leave their mark on the operating result and net income for 2004. The portfolios which the Group holds as investments in foreign currencies are valued at year-end exchange rates. These, together with the valuation of a strategic US dollar investment, will negatively impact the financial result (at the end of January 2005, these positions have already shown significant improvement). A prospective slight increase in the tax rate will also have an impact on net income as things stand today.

Judging by developments in the initial months of 2005, the Board of Directors and Executive Group Management Board are confident of attaining the ambitious goals set for the current year, although the ongoing strength of the Swiss franc combined with a very weak dollar and dollar-linked currencies will diminish the promising growth in local currencies after translation into Swiss francs.

The Group's strong cash flow and extremely solid financial position will make further expansion possible. The emphasis here will be mainly on organic growth via product and market offensives, but any acquisition opportunities that present themselves will be examined in-depth for the value they offer.

Source: swatch Group

www.swatchgroup.com