dd as it may sound, I have been loitering in the independent watch sector for over a decade, and seldom do I hear connoisseurs and collectors talk about ‘investment value’.

Maybe I spent a little too much time at Phillips auction house lately, the topic keeps surfacing in my head.

The financially-minded are often concerned about investment value when buying a luxury watch. Beyond merely serving as a style accessory, watches are conveniently touted as a viable alternative investment vehicle.

It seems sensible, certainly.

-

- Phillips hosted the Independent Watchmakers Exhibition world tour terminating in London. My millennial watch-enthusiast guests had the privilege of a private viewing of the masterpieces with the exhibition owner, Mr Claudio Proietti of Maxima Gallery.

Values

As is the case with other alternative assets such as cars and art, luxury watches could appreciate over time based on aspects like brand recognition, heritage, exclusivity, and desirability.

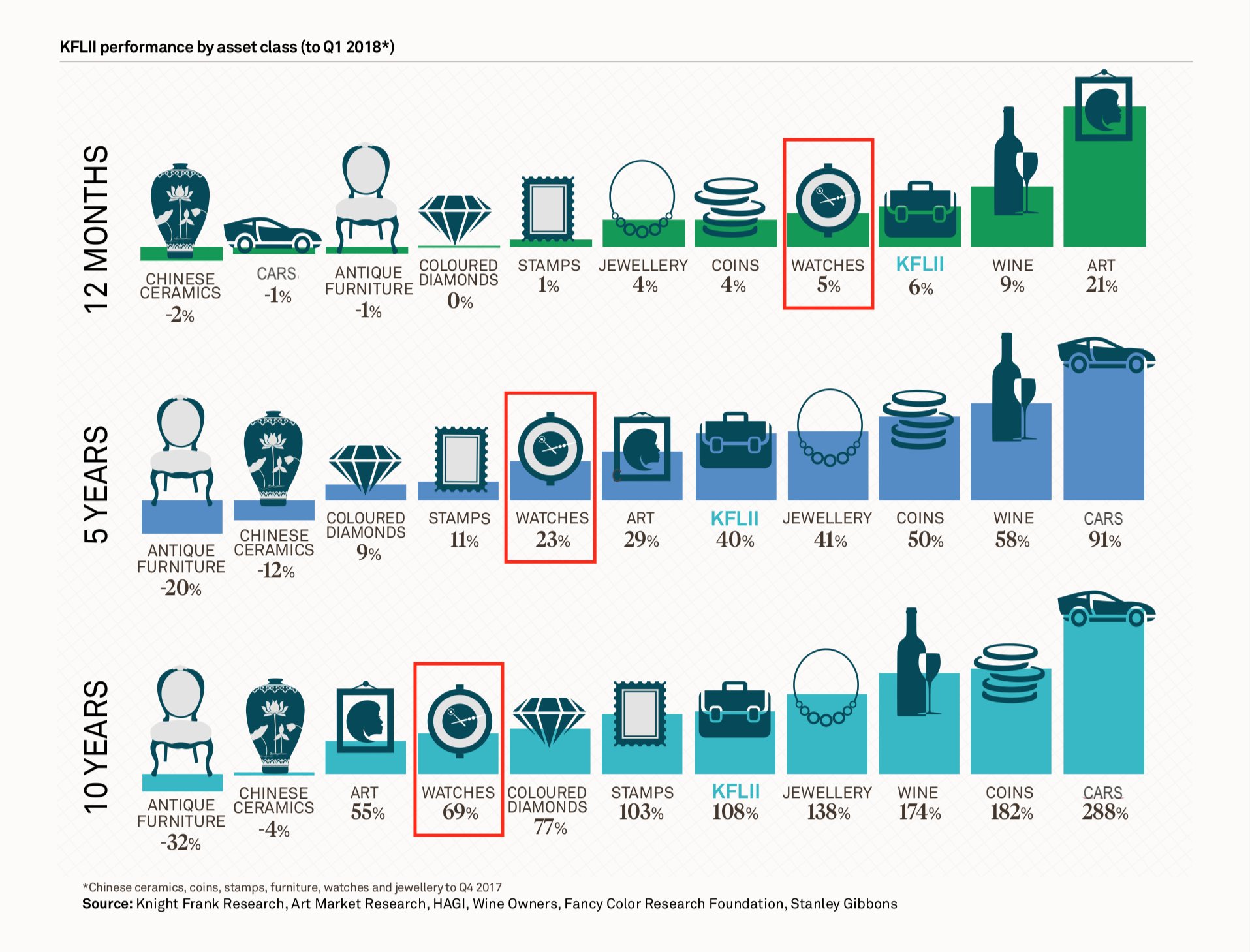

Mega independent houses Rolex and Patek Philippe are widely known to offer solid investments with some of their pieces. Unsurprisingly, rare editions and even historical watches could boost the selling price remarkably down the line. Overall, the latest Knight Frank Luxury Investment Index (KFLII) suggests a 69% growth over 10 years.

Decent returns?

When you look across all asset classes, the watch category is one of the poorest performing, falling below the KFLII averages.

According to the Pareto Principle, as in the 80/20 rule or the law of the vital few, which is generally observed in investing, even that 69% yield would only come from a very small amount of watches on the market. If watches is not a market you know inside out, or on which have a recognised expert to advise (ahem, not your dealer), you may be thinking too much if you want to buy luxury watches to grow value.

“Most watch enthusiasts don’t collect for the returns – any profit is an aside to the joy of owning a beautiful timepiece,” as Mohammad Syed, Head of Financial Advice and Investment Solutions at Coutts, was once quoted. “It isn’t advisable to see a watch, or a collection of watches, as a core component of your investment portfolio.”

The financially-minded are often concerned about investment value when buying a luxury watch. Beyond merely serving as a style accessory, watches are conveniently touted as a viable alternative investment vehicle.

It seems sensible, certainly.

Attitudes

That may explain why no one talks about investment value in my watch universe.

By and large, the two types of watch collectors I mingle with are, as illustrated by Christies’ watch specialists:

The Investor - When spending a substantial amount on a wristwatch, one likes to know that a newly acquired piece will hold its value over the years, while also providing joy on a daily basis. He goes for watches that are also good stores of value.

The Trendsetter - This type takes an approach to watch collecting that is uniquely his own. Seeking only to satisfy his soul and own horological desires, he is often seen wearing pieces from smaller brands. It’s the rare and captivating nature of these timepieces that makes it all worth it, and the market has been known to respond accordingly.

The market response is driven by the new age of information accessibility. People can educate themselves quite quickly, leading to buyers being more confident about what they’re purchasing and looking for something out of the ordinary.

Shanghai Watch Gang, the emerging millennial collectors group in China agrees, “There is a lot of transparency on the market. Collectors all want to differentiate. There is only so much money you can make out of a watch, so it is not about buying an expensive piece but something sought-after. The Chinese have a real thirst. They research a lot.”

-

- The new generation of watch collectors in China donning avant-garde independent brands on their wrists.

- © Shanghai Watch Gang

Trends

The rarity in the quantities the independent watchmakers can produce, due to limited capacity, may present greater value in years to come. “Limited collections always have an appeal. There is a resurgence of interest in independent watchmaking which will naturally lead through to values, ”witnessed by James Marks, Phillips’ International Specialist and Director, Watches. We at SKOLORR have been tracking the auction results in major capitals this year. Surely enough, we are seeing modern and boutique independent names with impressive performance beyond the usual suspects. F.P. Journe, Richard Mille, Greubel Forsey, MB&F, Laurent Ferrier, Ferdinand Berthoud, Ludovic Ballouard, and Sarpaneva all achieved above maximum estimates.

Monetary value aside, we place an emotional value on something unique, something personal, something we connect with. What no one talks about is the ‘self-value’ one sees on his wrist. Everything we choose, we do, we wear, down to the watch we own, is an expression of oneself. It represents our self-image.

“There is a lot of transparency on the market. Collectors all want to differentiate. There is only so much money you can make out of a watch, so it is not about buying an expensive piece but something sought-after. The Chinese have a real thirst. They research a lot.”

“With independents, it’s more of a love affair. Buying with your heart as opposed to buying with your head. If you get a Rolex, you’re buying what 80% of people do. If you are different, or don’t want to follow, then go for the independents,” says the man who has the most popular IG profile as a respected connoisseur in the collectors’ circle, aka @Santa_Laura.

Time is changing. The independents are no longer the preserve of the collectors. And when you are part of the trend, you know you are just being yourself.

Let me know your thoughts, or join me for a one-to-one conversation at [email protected]