Carried out by Luxury Digital Marketing Firm IC-Agency in partnership with Europa Star and with the support of the Fondation de la Haute Horlogerie, the 6th edition of the WorldWatchReport deciphers queries entered into search engines throughout the Internet from millions of prospects for 25 luxury watch brands. The survey covers 10 key markets, including – for the first time - BRIC markets Brazil, Russia, India and China as well as the top export markets United States, Japan, the United Kingdom, Italy, France and Germany.

IC-Agency is delighted to share with the readers of Europa Star the main trends highlighted by the study and first uncovered for the Salon International de Haute Horlogerie in Geneva a few weeks ago.

Increase of haute horlogerie

The global search volume linked to the 10 haute horlogerie brands increased by 14% compared to 2008. An encouraging sign showing the interest for exclusive products with an average value above CHF 15,000, despite a difficult economical context.

Blancpain, Jaeger-LeCoultre and Audemars Piguet realize the best performances for the haute horlogerie category with strong online increases of 115%, 114% and 81%, respectively. The biggest slow down concerns Zenith (-51%). Yet, the brand remains the second most searched for in this category with 16.3% of search volume, behind IWC (24.7%).

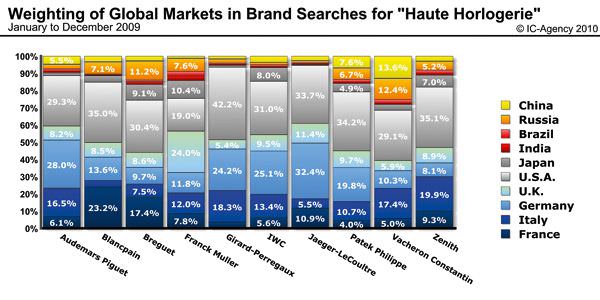

The United States are still the number one market for haute horlogerie brands with the share of searches ranging from 42.2% for Girard-Perregaux to 19% for Franck Muller.

Germany, the biggest market in Europe in terms of Internet users, shows a strong interest for haute horlogerie brands, especially for Jaeger-LeCoultre, Audemars Piguet and IWC, with 32.4%, 28% and 25.1% market share, respectively.

China confirms its growing hunger to buy high-end watchmaking brands. The report demonstrates significant search volumes from this market notably for Vacheron Constantin, Patek Philippe and Audemars Piguet with 13.6%, 7.6% and 5.5% market share, respectively. Did the recent PR campaigns and VIP events organ-ized for the numerous recent brand boutique openings – Vacheron Constantin’s mansion in Shanghai, Patek Philippe’s second boutique in Beijing and Audemars Piguet’s first boutique in Macau – impact their notoriety levels on the Chinese clientele?

The most in-demand haute horlogerie models

Among the 120 models analyzed in the haute horlogerie category, the three most popular ones are Jaeger-LeCoultre’s Reverso (8.2%), Audemars Piguet’s Royal Oak (7.1%) and IWC’s Portuguese (6.3%).

This trio accounts for 21.6% of product-related searches for haute horlogerie. The other models (more than one hundred) represent almost 80% of the remaining demand for this category, showing how fragmented this market is. Some new models also made their way into this ranking such as IWC’s Pilot and Spitfire collections, Zenith’s El Primero and Blancpain’s Flyback.

Watch ambassadors

Adding India to the study’s scope results in Audemars Piguet and Sachin Tendulkar, the famous Indian cricket player, leading the ranking of the most searched for haute horlogerie brand ambassadors. Indeed, more than one out of two searches (55%) concern Tendulkar, pushing the 2008 number one Jaeger-LeCoultre and actress Diane Kruger to second place.

In the coming years, it is likely that other ambassadors coming from the BRIC markets are going to challenge Hollywood actors and renowned athletes.

BRIC markets

Demand coming from Brazil, Russia, India and China already account for more than 12% of global searches for prestigious watch brands.

As eighth export market according to the FHS (Jan-Oct. 2009), China alone accounts for 38% of the demand coming from the BRIC markets, followed by Brazil, Russia and India with 28%, 20% and 14% respectively. In these markets, Patek Philippe, Zenith and IWC are the three most searched for haute horlogerie brands with 2.3%, 2% and 1.9% of the demand.

It is interesting to see that the Internet positions itself as a media able to reach consumers living in these emerging markets, in which culture and appetite for luxury watches are constantly rising.

The other 25 brands

Additional and more detailed results about the 25 brands in the 10 markets analyzed will be revealed during the WorldWatchReport official launch at BaselWorld in March 2010. Stay Tuned with Europa Star to be updated with the full report release or visit www.worldwatchreport.com.

Source: Europa Star February-March 2010 Magazine Issue